HKTDC Export Index 3Q22: Gradual Recovery Underway

- Overall, the jewellery sector had the highest sub-index at 44.2, followed by toys (37.0). Jewellery also enjoyed the largest improvement, recording a 9.9-point increase over the previous quarter, while the electronics sector gained 2.3 points to 32.7.

- Asia continued to be seen as the major market with the most promising outlook on the part of many Hong Kong exporters, with all of its constituent economies showing an improvement in their index rating. Optimism among exporters regarding the US, meanwhile, remained steady, while confidence in the EU declined.

- Japan remained the best performer with a score of 48.4, followed by the ASEAN bloc (46.9) and mainland China (45.8). ASEAN (up 3.6 points) and mainland China (up 2.7 points) showed the greatest improvements for the quarter overall.

- In another telling finding, exporters are facing downward pressure on prices, as indicated by a fall in the Trade Value Index of 11.5 points to 40.2.

- More reassuringly, the impact of the ongoing Covid-19 pandemic on business was seen as continuing to recede. Although 77.9% of respondents maintained that the pandemic was still having a negative impact on their business, the scale of that impact appears to have declined. As testimony to this, 54.5% of respondents said the impact of the pandemic was now only slightly negative, while the proportion of respondents saying that their business had been very negatively affected fell 11.8 percentage points to 23.4%.

- Rising transportation costs (cited by 64.1% of respondents) and logistics disruptions (51.8%) remained the most significant challenges for businesses. As these figures had fallen significantly from the previous quarter (by 8.5 and 13.4 percentage points, respectively), such concerns appear to be less pressing than had previously been the case, an outcome inevitably related to the gradual easing of supply chain issues.

- The majority of respondents also indicated that the shortening of the Covid quarantine requirement to a seven-day centralised stay plus a three-day home confinement on the part of the mainland government would only have a positive effect on their businesses. More specifically, the advent of more flexible business travel arrangements, the gradual resumption of cross-border commerce and trade, and smoother flow of production were seen as the primary benefits.

- The pandemic (cited by 40.2% of respondents) and closed borders (22.6%) were, however, seen as expected to remain the major impediments to export performance.

- According to the survey, many Hong Kong exporters now also appear to embrace alternative business strategies, with a significant proportion shifting from being market-focused towards prioritising product development and cash-flow management. In more specific terms, developing other product categories (36.9%) and cash flow-optimising financial stability (35.6%) were the two most common trends to emerge.

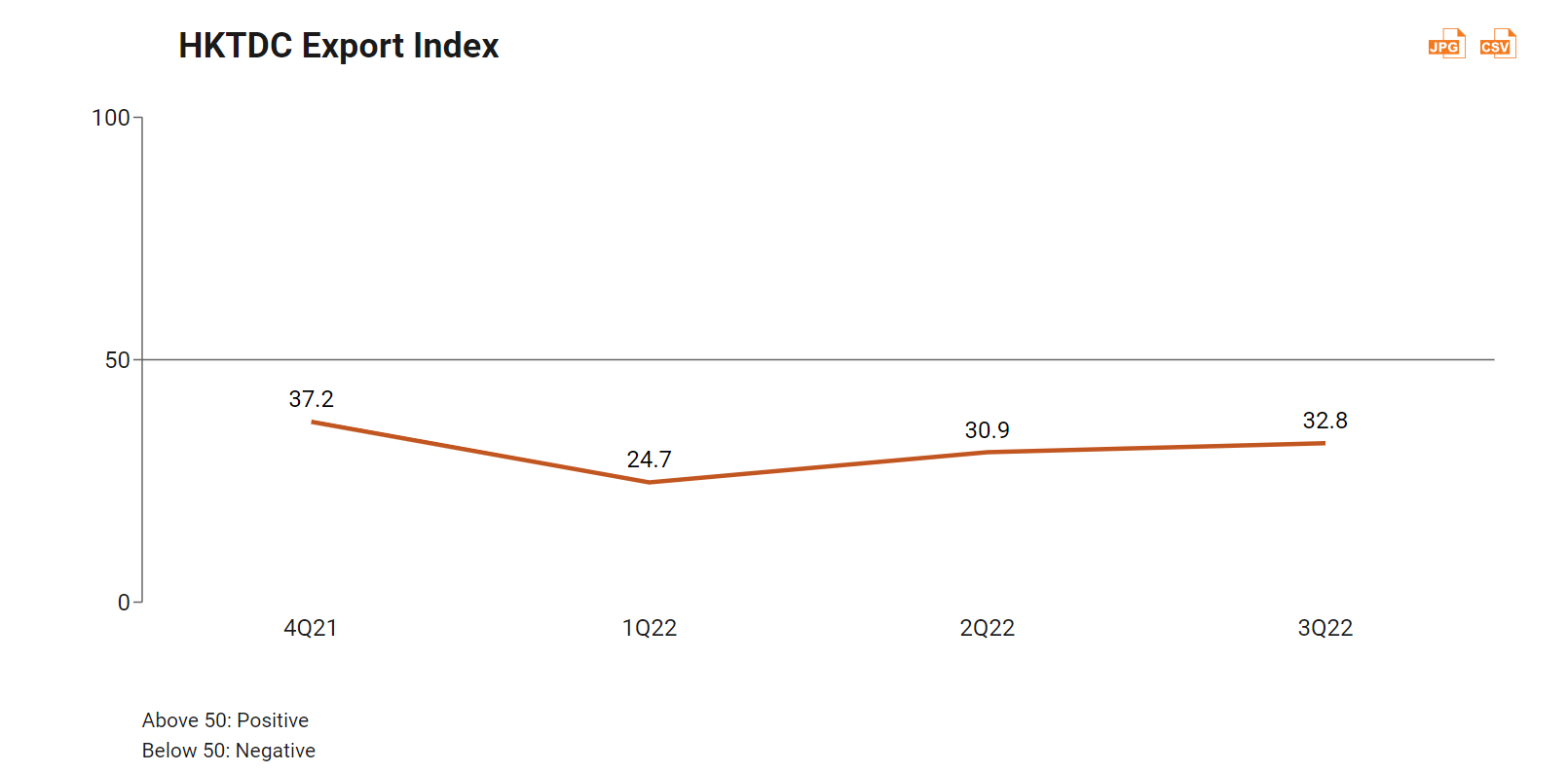

For 3Q22, the HKTDC Export Index rose to 32.8, an improvement on both 2Q22’s 30.9 and 1Q22’s 24.7. This marks the second straight quarter in which optimism with regard to their short‑term prospects has notably increased among Hong Kong exporters. The pace of recovery was, however, weaker than expected, largely due to concerns over the deteriorating external environment. In particular, demand in many of the major markets was seen as being dampened by high inflation and aggressive monetary tightening, while escalating China‑US trade tensions and the fallout from the Russia‑Ukraine conflict was also viewed as clouding the export outlook.

In terms of industry sectors, jewellery was seen as the most promising. This saw it record the highest sub‑index figure (44.2), with toys (37.0) in second place. Jewellery also saw the largest improvement in its score, with a 9.9‑point increase from the previous quarter, while the electronics sector showed the second‑largest improvement, rising 2.3 points to 32.7. Optimism among exporters in the machinery and clothing sectors, meanwhile, dropped slightly, with the indices for the two sectors down by 2.8 and 2.2 points, respectively.

Period | HKTDC | Electronics | Clothing | Toys | Jewellery | Timepieces | Machinery |

3Q22 | 32.8 | 32.7 | 31.2 | 37.0 | 44.2 | 33.8 | 34.9 |

2Q22 | 30.9 | 30.4 | 33.4 | 38.7 | 34.3 | 34.6 | 37.7 |

1Q22 | 24.7 | 24.5 | 28.0 | 33.5 | 23.5 | 19.7 | 25.0 |

4Q21 | 37.2 | 37.0 | 39.6 | 25.0 | 40.7 | 37.5 | 44.1 |

Turning to the major markets, Hong Kong exporters were increasingly optimistic in the case of Asia, with improvements recorded for all the related market sub‑indices. ASEAN (up 3.6 points), mainland China (up 2.7 points) and Japan (up 0.8 points) were the strongest performers. Japan recorded the highest sub‑index at 48.4, followed by ASEAN (46.9) and mainland China (45.8). The US sub‑index remained steady at 41.1, with its economic momentum seen as likely to be dampened by higher inflation and aggressive monetary tightening. The EU (40.5) recorded a 1.8‑point drop as concerns over inflation and the fallout from the Russia‑Ukraine conflict clouded the regional outlook.

HKTDC Export Index | US | EU | Japan | Mainland China | ASEAN |

3Q22 | 41.1 | 40.5 | 48.4 | 45.8 | 46.9 |

2Q22 | 41.2 | 42.3 | 47.6 | 43.1 | 43.3 |

1Q22 | 39.1 | 39.5 | 45.6 | 42.1 | 41.2 |

4Q21 | 42.9 | 43.9 | 48.7 | 47.6 | 45.8 |

Sentiment regarding offshore trade (i.e. shipments not passing through Hong Kong but handled by the city’s businesses) was, however, relatively downbeat, as indicated by the Offshore Trade Index, which dropped slightly in 3Q22, down 1.2 points from 23.1 to 21.9.

First, please LoginComment After ~