time:

2023-03-02 09:54:13

views:

40418

time:

2023-02-02 11:31:08

views:

34708

time:

2023-01-12 08:35:53

views:

35220

The Banque centrale du Luxembourg (BCL) informs that, based on preliminary data, the main interest rates applied by Luxembourg’s credit institutions to euro area households and non-financial corporations (NFCs) for their loan and deposit operations have on average evolved as follows in September 2022.

time:

2022-11-17 17:24:12

views:

33696

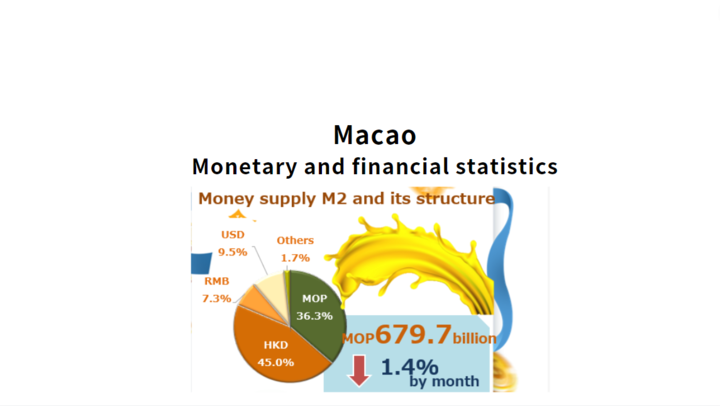

According to statistics released today by the Monetary Authority of Macao, broad money supply retreated in September. Meanwhile, resident deposits fell from a month ago whereas loans to residents posted an increase.

time:

2022-11-04 08:00:00

views:

73565

The Banque centrale du Luxembourg (BCL) informs that, based on preliminary data, the main interest rates applied by Luxembourg’s credit institutions to euro area households and non-financial corporations (NFCs) for their loan and deposit operations have on average evolved as follows in August 2022.