MAS requires a digital full bank (DFB) to progressively build up its business model and risk management capabilities as it grows.

time:

2023-08-09 16:25:00

views:

42185

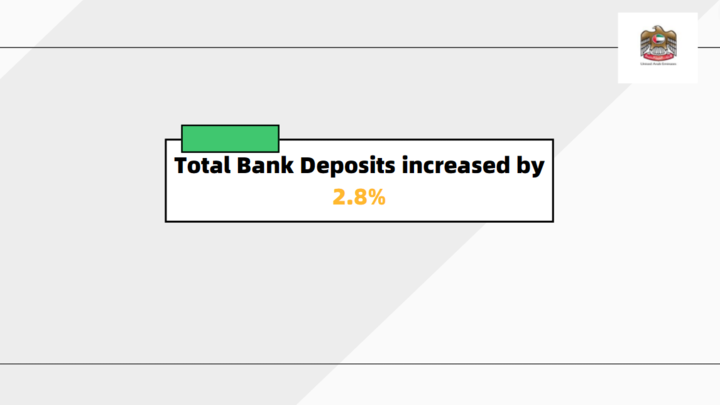

Total Bank Deposits increased by 2.8%, rising from AED 2,242.3 billion at the end of February 2023 to AED 2,306.0 billion at the end of March 2023.

time:

2023-06-13 14:58:00

views:

25123

time:

2023-06-07 08:44:31

views:

24420

time:

2023-01-12 08:35:53

views:

32942

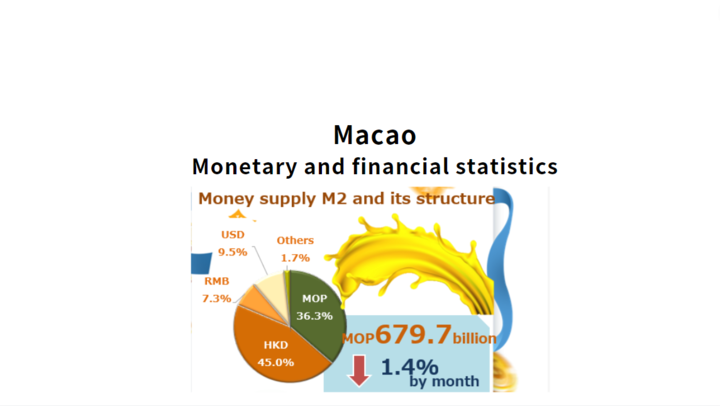

According to statistics released today by the Monetary Authority of Macao, broad money supply retreated in September. Meanwhile, resident deposits fell from a month ago whereas loans to residents posted an increase.

time:

2022-11-04 08:00:00

views:

69427

According to statistics released today by the Monetary Authority of Macao, broad money supply continued to grow in August. Meanwhile, both resident deposits and loans increased from a month earlier.

time:

2022-10-08 08:00:00

views:

55290

The inversion of medium and long-term deposit rates has revealed banks' wish to reduce the cost of liabilities.

time:

2022-08-03 13:55:27

views:

55399

The cap on such deposits is 10 billion yuan ($1.48 billion) for each bank.

time:

2022-07-30 15:08:16

views:

70205

The M2, a broad measure of money supply that covers cash in circulation and all deposits, increased 11.4 percent year on year to 258.15 trillion yuan at the end of last month