- All

- B2B

- Apex

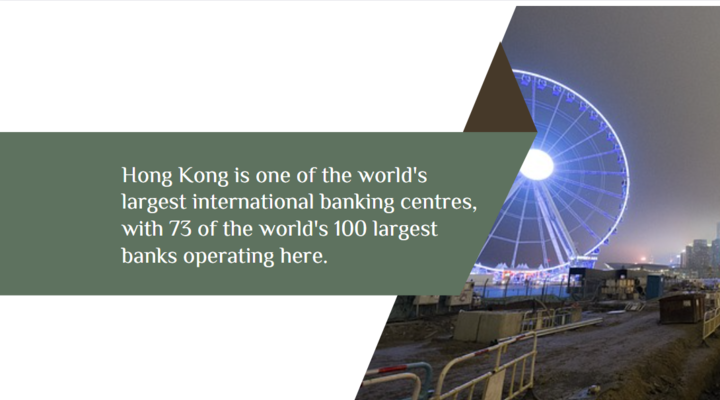

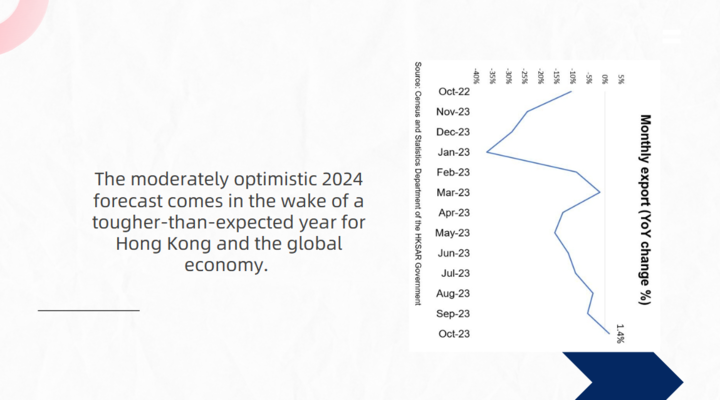

- Banking

- capital market

- investment

- corporate banking

- UAE

- supervision

- Credit guarantee

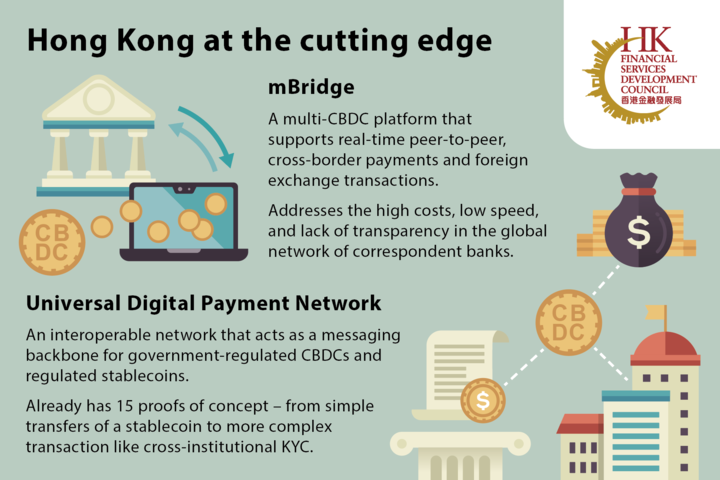

- Payment settlement

- Financial training

- Investment promotion

- Equity investment

- Checkthe

- sdefault

- AIM

- G2B

- corporate bond

- FS Club

- AIM Congress

- Internal Audit

- Corporate Services

- Valuation services

- G2G