International Buyers Share Short to Mid-Term Business Outlook

International buyers anticipate steady path forward amidst challenges

Faced with today’s challenging market, many businesses are still experiencing limited growth on their course to recovery from the pandemic. As 2022 comes to a close, HKTDC asked buyers about sourcing in today’s environment and their expectations for business performance in the short (6‑12 months) to mid‑term (12‑24 months).

In these latest findings1, HKTDC observes that the majority of international buyers anticipate their firms to proceed relatively conservatively into the new year. With companies slated to stay their current course, buyers foresee incremental, albeit significant, progress in the pipeline.

Modest yet promising expectations for a rebound

While buyers expect companies to tread carefully moving forward, the survey revealed plenty of cautious optimism.

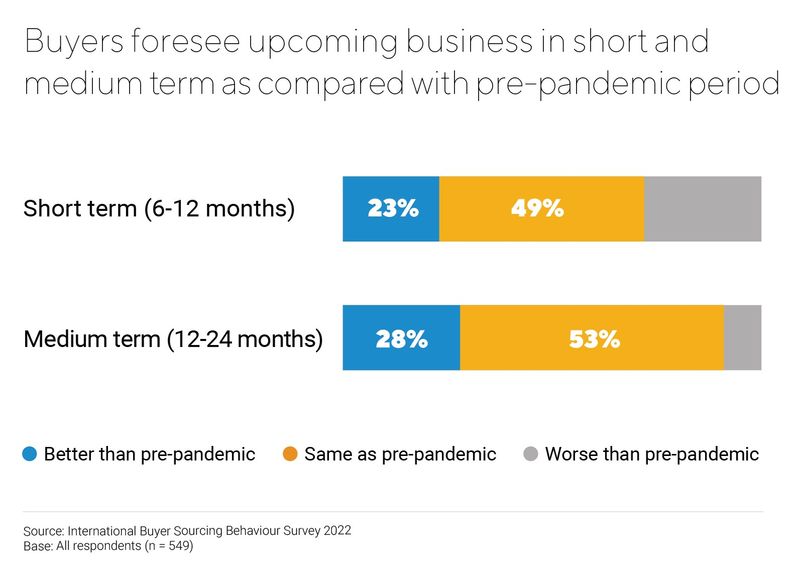

Approximately half of buyers believe that business will bounce back to pre‑pandemic levels in both the short (6‑12 months) and mid‑term (12‑24 months). A rebound to pre‑pandemic business would mark an important milestone for many in a prolonged recovery process.

Furthermore, there is a segment of buyers who are more bullish about the coming year. Nearly a quarter of buyers expect business will surpass (not only meet) pre‑pandemic levels in 2023. When extending the timeline into 2024, the number goes up as 28% of buyers believe mid‑term business performance will exceed pre‑pandemic benchmarks.

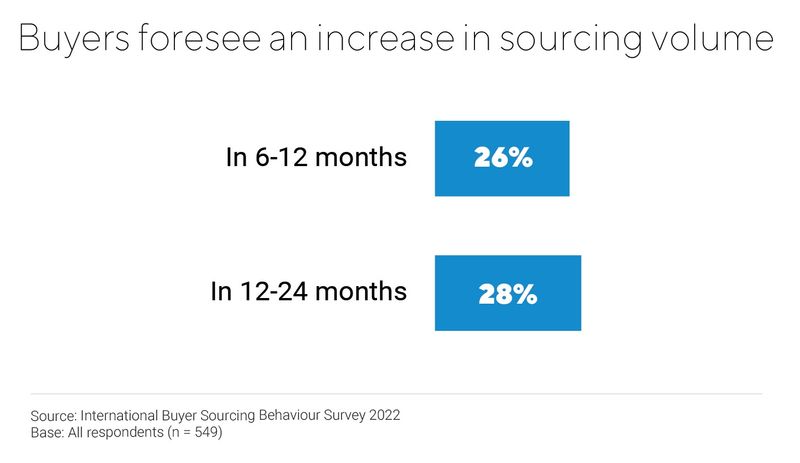

Any such resurgence will likely be accompanied by increased sourcing volume. 26% of buyers anticipate increased sourcing volume in the short‑term, while 28% expect increased levels in the next 12‑24 months.

Current Sourcing Considerations

The state of the domestic economy and digitalisation looms large on buyers

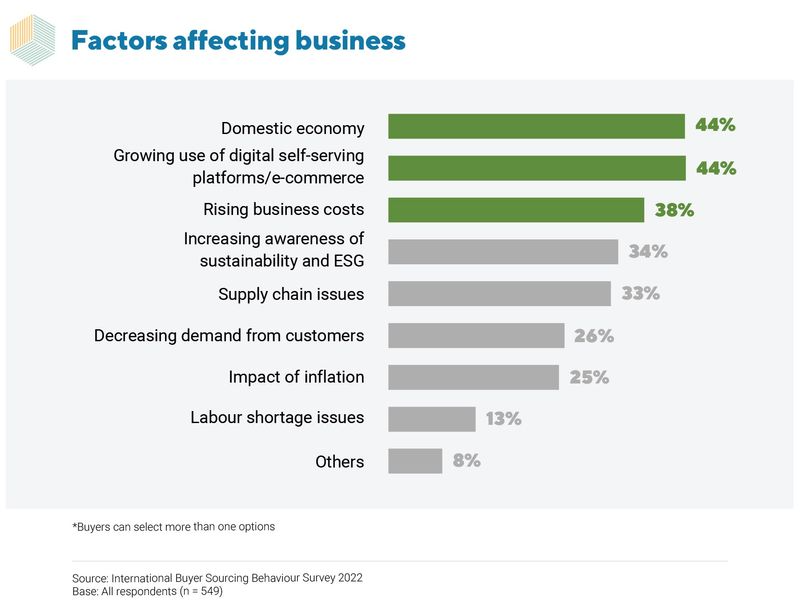

When discussing factors affecting business, buyers share a mix of macro and microeconomic considerations. First and foremost, 44% of buyers believe that the recovering state of the domestic economy to be the major overriding influence. The next top‑of‑mind criteria impacting business is the growing adoption of digital self‑serving platforms (e.g. e‑commerce), followed by rising business costs.

Buyers’ continuously growing demand for product variety synergises with engaging more suppliers

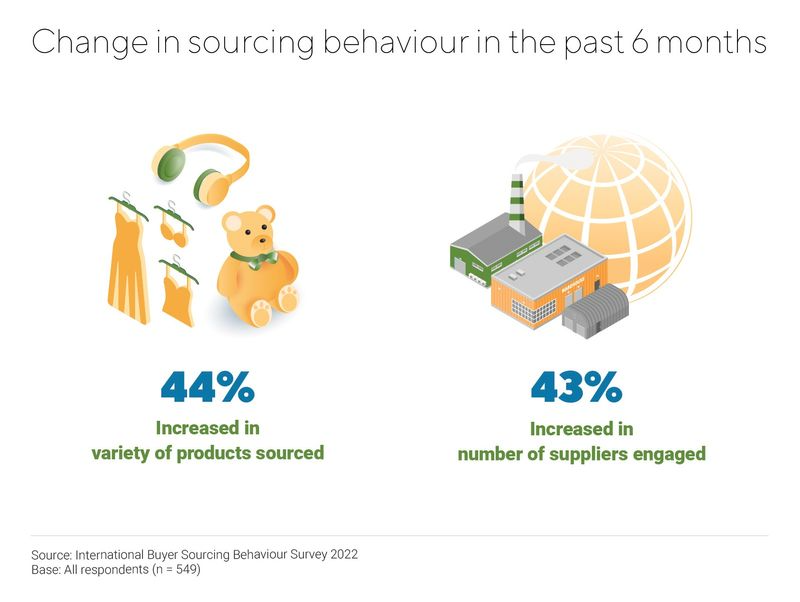

Although buyers have a robust existing product portfolio, the majority are still looking to diversify with increased product variety (44%). Consequently, buyers are looking to engage more suppliers (43%) as they expand their horizons. This trend is consistent with behaviour observed earlier this year. Buyers and suppliers can reasonably expect that the demand for product variety will continue influencing sourcing decisions into the immediate future.

Less frequent sourcing amidst supply chain delays means reliability is imperative

Protracted sourcing due to delays along the entire supply chain remains a significant barrier to buyers and suppliers. With less frequent sourcing, buyers seek reliable suppliers and partners who can meet their sourcing needs with transparency and timeliness. Trust continues to be the top non‑negotiable for buyers looking to ensure their product supply and quality.

An Evolving Landscape

Buyers appreciate physical trade shows but gravitate towards virtual and hybrid trade shows in today’s environment

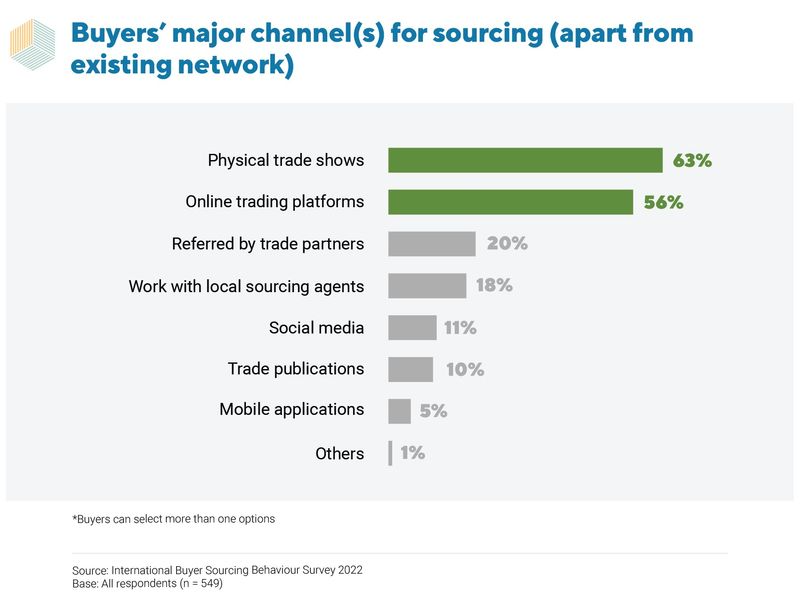

When looking to source beyond their existing network of suppliers, buyers have generally preferred seeking new partners via physical trade shows and online trading platforms. As the pandemic necessitated digitalisation, virtual and hybrid trade shows emerged to help reshape the sourcing landscape.

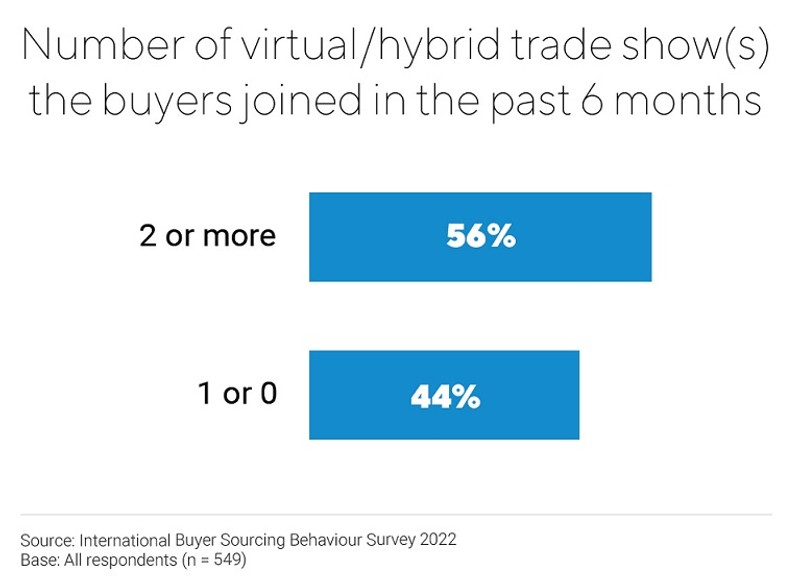

In the latter half of the year, the virtual and hybrid format has shown staying power as they continue to experience an uptick in popularity. Over the past six months, 43% of buyers have attended virtual and hybrid trade shows more frequently, with close to 60% of buyers joining more than two virtual trade shows during this period. In contrast, only 7% of surveyed buyers did not attend any form of virtual or hybrid trade shows.

What the current state of sourcing could mean to the Hong Kong market

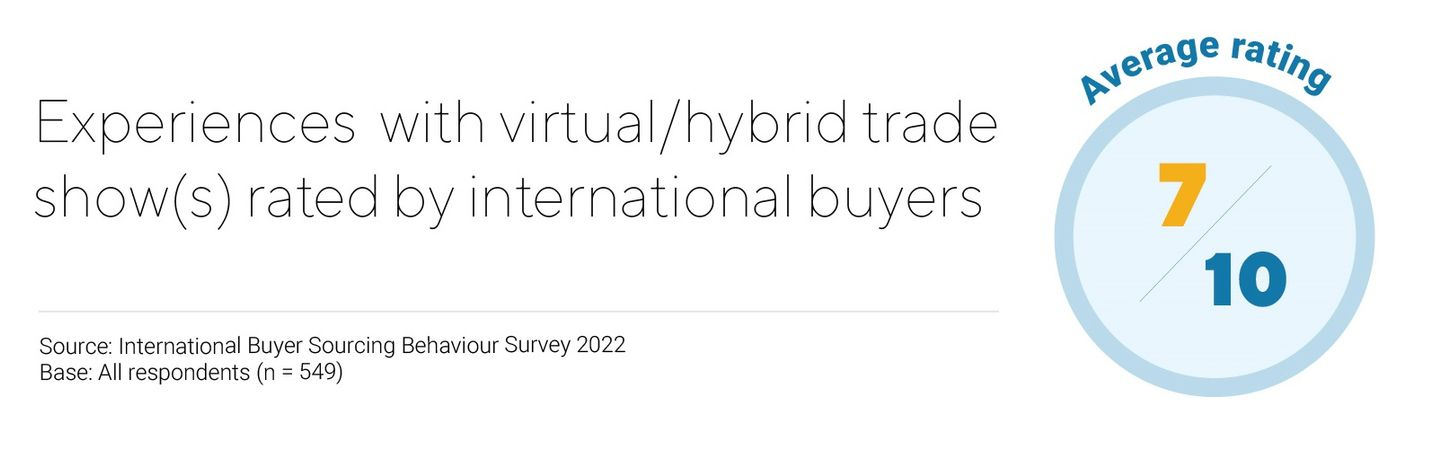

As virtual and hybrid trade shows have become mainstream, buyers expressed satisfaction with offerings thus far. Surveyed buyers gave virtual/hybrid trade show experiences a 7 out of 10 score on average, showing that there is room for opportunity in this growing space.

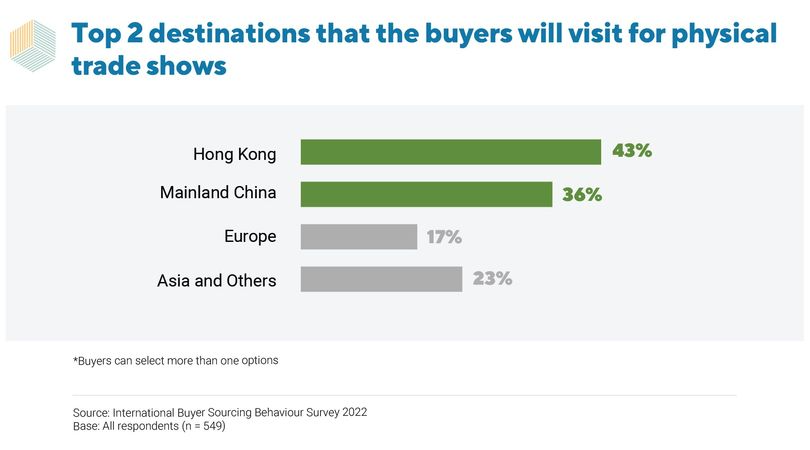

But as restrictions begin to lift and physical trade shows make their way back on the schedule, buyers expressed high interest in sourcing from suppliers within the region. The majority of surveyed buyers selected Hong Kong and Mainland China as their two top destinations to visit for physical trade fairs.

And while buyers still prefer identifying new products and suppliers at physical trade shows – especially in Hong Kong and Mainland China – the survey results have shown that they now do so with the support of online sourcing platforms.

With such being the case, a trusted platform that combines the best of both physical trade shows and online sourcing platforms should be well‑positioned to be the optimal sourcing channel for buyers moving forward.

1International Buyer Sourcing Behaviour Survey 2022 was conducted by HKTDC during the period of September – October 2022. HKTDC surveyed 549 international buyers online and at trade shows.

First, please LoginComment After ~