April results of the Bank Lending Survey in Germany

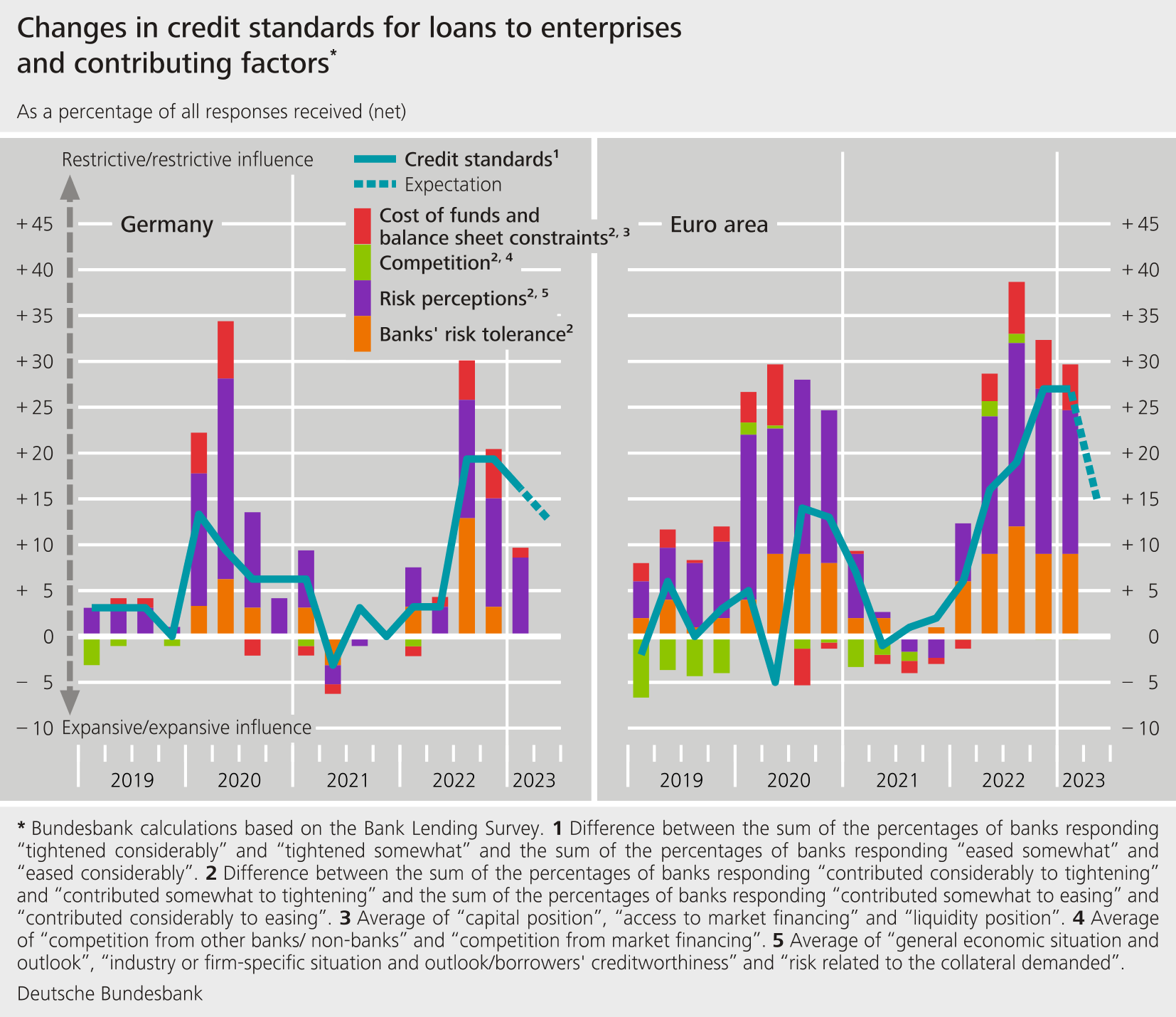

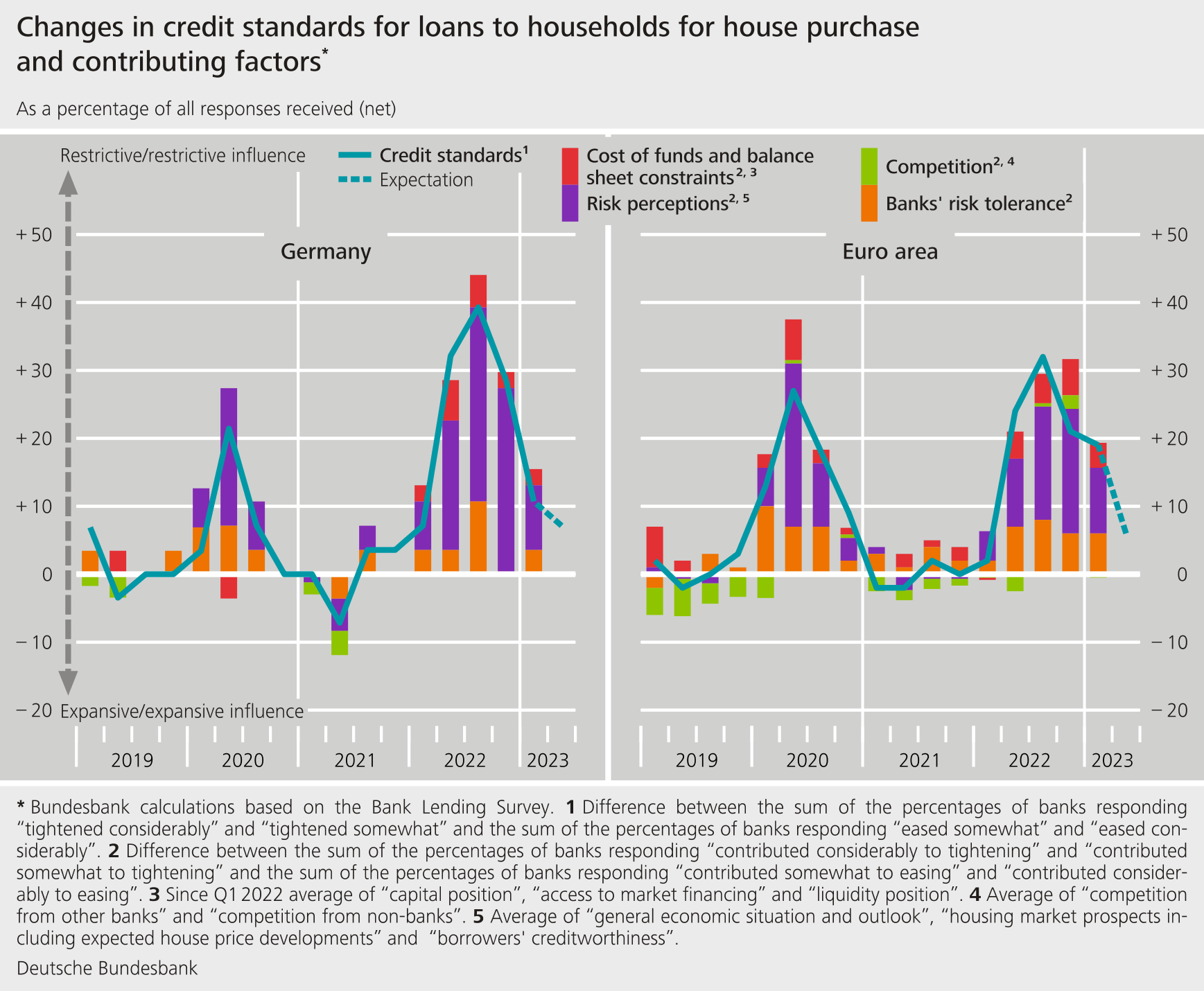

- ♦ The German banks responding to the Bank Lending Survey (BLS) tightened their credit standards for loans to enterprises, loans to households for house purchase, and consumer credit and other lending in the first quarter of 2023. The adjustments were less restrictive than in the fourth quarter of 2022 and matched the plans announced in the previous quarter relating to loans to enterprises and loans to households for house purchase. The banks justified the tightening in all loan categories primarily on the grounds of higher credit risk.

- ♦ Credit terms and conditions were tightened for loans to enterprises and for consumer credit and other lending. They were eased for loans to households for house purchase, as indicated by a narrowing of margins.

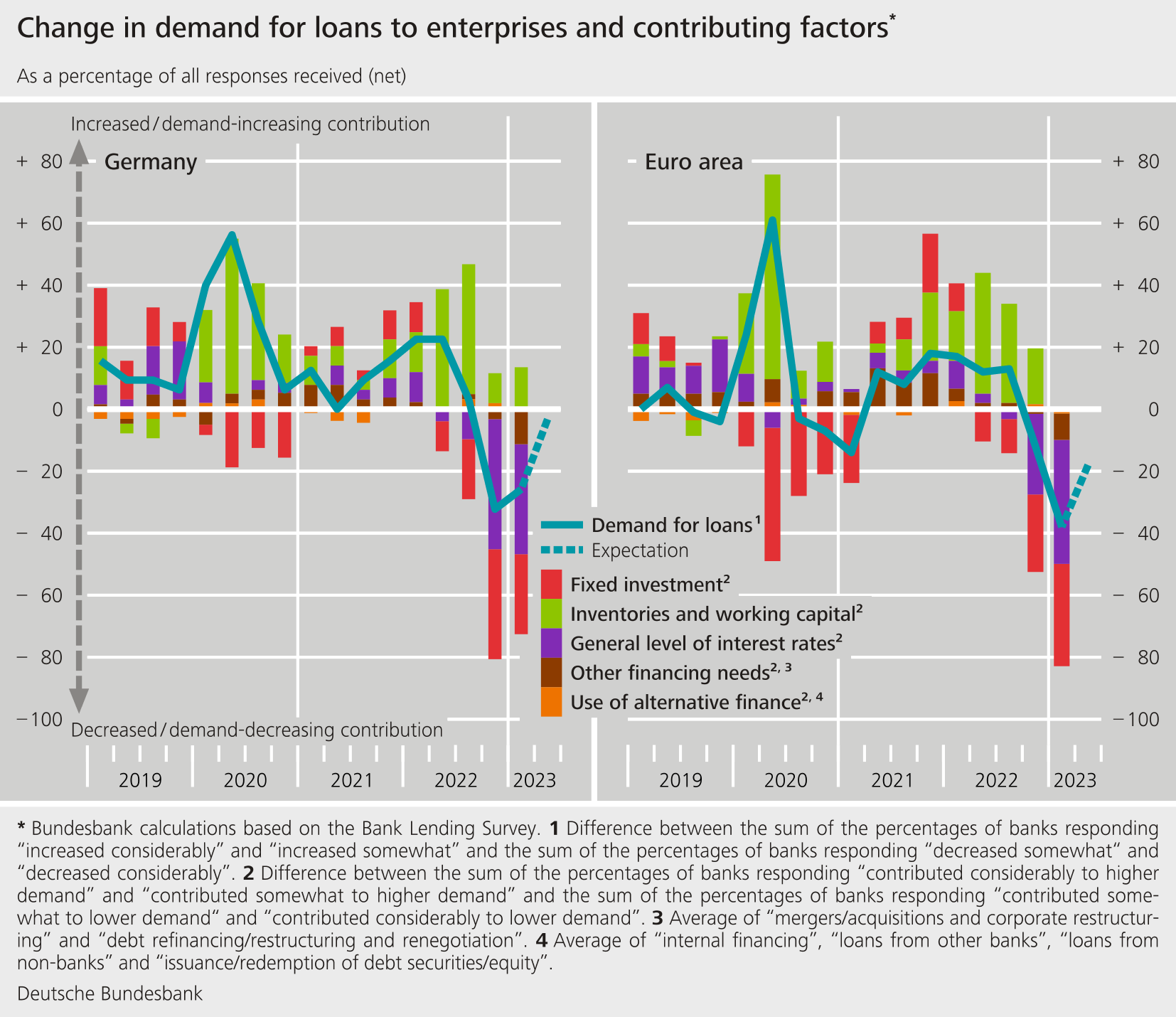

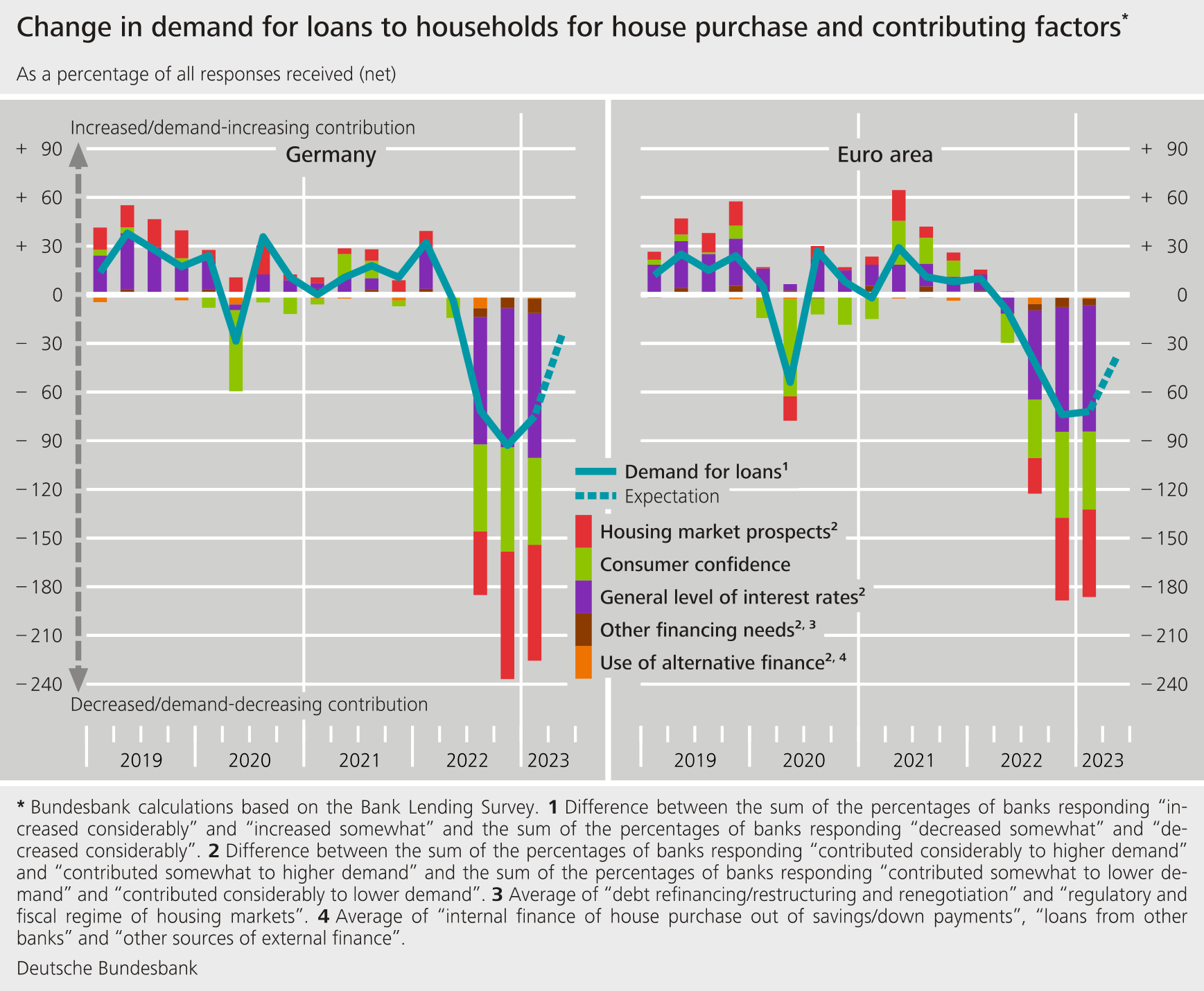

- ♦ Loan demand diminished in all three loan categories. There was a particularly strong decline in demand for loans to households for house purchase, which dropped significantly for the third time in succession.

- ♦ The changes in the monetary policy asset portfolio that can arise as a result of net purchases or incomplete reinvestments impacted negatively on banks’ market financing conditions over the past six months. They did not lead to any changes in credit standards and credit terms and conditions, however.

- ♦ Banks continued to benefit from the liquidity provided by the third series of targeted longer-term refinancing operations (TLTRO III). That said, the positive direct and indirect effects of the TLTRO III operations on banks’ financial situation continued to peter out over the past six months.

The BLS covers three loan categories: loans to enterprises, loans to households for house purchase, and consumer credit and other lending to households. On balance, the surveyed banks made their credit standards (i.e. their internal guidelines or loan approval criteria) more restrictive in all three loan categories. The net percentage of banks that tightened their requirements was +16% for loans to enterprises (compared with +19% in the previous quarter), +11% for loans for house purchase (compared with +29% in the previous quarter), and +14% for consumer credit and other lending (compared with +25% in the previous quarter). The banks justified the stricter standards on the grounds of higher credit risk perceptions.

The primary reasons for this increase in risk in corporate lending were the deterioration in the general economic situation and outlook, as well as industry and firm-specific factors. As regards loans for house purchase, the bleaker outlook in the housing market and the decline in borrowers’ creditworthiness were the main factors, alongside the deterioration in the general economic situation and outlook. For the second quarter of 2023, banks are planning to tighten their credit standards further on balance in all three loan categories. Compared with the current tightening, the adjustments affecting loans to enterprises and loans to households for house purchase are expected to be smaller, however.

On aggregate, banks tightened their terms and conditions (i.e. the terms and conditions actually approved as laid down in the loan contract) yet again for loans to enterprises, but by less than in the last two survey rounds. This tightening was reflected primarily in a widening of margins and increased collateral requirements. For the first time in five quarters, the banks eased their terms and conditions overall for loans to households for house purchase. The adjustments were made exclusively to margins, with banks citing heightened competition as the reason. The banks tightened their terms and conditions for consumer credit and other lending. The turmoil surrounding the collapse of Silicon Valley Bank (SVB) and the problems at Credit Suisse in March does not, then, appear to have impacted on German banks’ lending policy.

Corporate loan demand declined yet again, but by less than in the previous quarter. As before, it was primarily the higher general interest rate level and enterprises’ reluctance to engage in fixed investment that dampened demand for loans, primarily long-term ones. Financing needs for inventories and working capital continued to increase, meanwhile. The loan rejection ratio once again rose markedly on the quarter.

Demand for loans for house purchase declined considerably for the third time in succession. Banks cited the higher general interest rate level, the significantly worse housing market outlook as perceived by borrowers and the drop in consumer confidence as the main reasons for this decline. The loan rejection ratio increased yet again, but not as significantly as in the previous quarter. Demand for consumer credit and other lending once again declined to a considerable degree. Over the next three months, the banks are expecting demand for loans to enterprises to stabilise. In the case of loans to households for house purchase and consumer credit and other lending, meanwhile, they expect to see a further decline in demand, albeit weaker, in their view, than in the first quarter of 2023.

The April survey contained ad hoc questions on banks’ financing conditions, the impact of the Eurosystem’s monetary policy asset portfolio and the TLTRO III operations. In addition, an ad hoc question on the impact of the key interest rate decisions of the ECB’s Governing Council was included for the first time.

Against the backdrop of conditions in financial markets, German banks reported that their funding situation had deteriorated somewhat compared with the previous quarter, including as regards the issuance of medium to long-term debt securities. The changes in the Eurosystem’s monetary policy asset portfolio that can arise as a result of net purchases or incomplete reinvestments barely impacted on banks’ liquidity position and their profitability over the past six months. The effect on banks’ market financing conditions was negative, meanwhile. This is likely to reflect the discontinuation of net asset purchases as of July 2022 and the reduction in reinvestments since March 2023. The changes in the monetary policy asset portfolio did not lead to any changes in banks’ credit standards and credit terms and conditions, though. They did, however, contribute to a decline in lending volumes for loans to households for house purchase and consumer credit and other lending. Banks reported that the TLTRO III operations once again contributed directly or indirectly to a more comfortable liquidity position and to an increase in profitability in the winter half-year (October 2022 to March 2023). They also helped improve banks’ ability to fulfil regulatory and supervisory requirements. Compared with the summer half-year (April to September 2022), these influences decreased significantly, however. Banks reported that the TLTRO III operations have not had any noteworthy impact on their credit standards, credit terms and conditions, or lending volumes over the past six months. The Eurosystem’s key interest rate hikes have had, overall, a positive impact on banks’ profitability over the past six months. They placed a strain on net non-interest income but improved net interest income markedly.

The Bank Lending Survey, which is conducted four times a year, took place between 22 March and 6 April 2023. In Germany, 33 banks took part in the survey. The response rate was 100%.

First, please LoginComment After ~