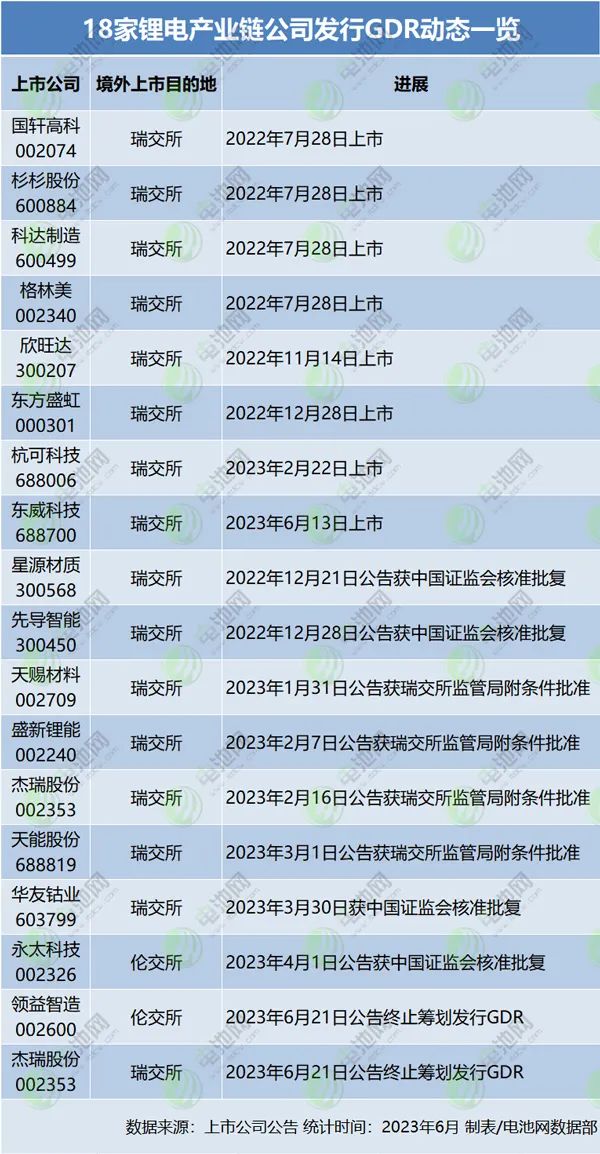

The rules for overseas financing continue to improve! Inventory of GDR Issuance Progress of 18 Lithium Battery Industry Chain Companies

Since 2022, over 18 companies in the lithium battery field have successfully issued GDR or are actively promoting various work related to GDR issuance. From the perspective of issuance progress, 8 companies have successfully issued, 8 companies are advancing their issuance matters, and 2 companies have officially announced termination.

At the beginning of June, the Shanghai and Shenzhen Stock Exchanges solicited public opinions on the revised Interim Measures for the Listing and Trading of Interconnected Depositary Receipts, and proposed to clarify the listing conditions of new domestic basic stocks of GDR (Global depository receipt) and the relevant arrangements for the issuance review, including that the overseas issuance and listing of GDR needs to be listed on the Shanghai and Shenzhen Stock Exchanges for at least one year, and the average market value of the 120 trading days before the application date is not less than 20 billion yuan. The interim measures also specify the information disclosure requirements for listed companies during the planning and overseas issuance of GDR, and timely disclose the progress at the specified time points.

Currently, the overseas issuance and listing of GDR and other overseas financing rules have undergone multiple adjustments, promoting the long-term healthy development of GDR business:

In October 2018, the CSRC issued the Regulatory Provisions on the Interconnection of Depositary Receipts between the Shanghai Stock Exchange and the London Stock Exchange (for trial implementation), formally establishing the interconnection mechanism between the London Stock Exchange and the Shanghai Stock Exchange. Through the arrangement of cross-border conversion mechanism between depositary receipts and underlying securities, the two markets can achieve interconnection.

In February 2022, the China Securities Regulatory Commission issued the "Regulations on the Supervision of Interoperability of Depositary Receipts Business between Domestic and Foreign Stock Exchanges", guiding A-share companies to issue GDRs in Switzerland, the United Kingdom, and Germany for listing and trading. In July of the same year, the China Securities Regulatory Commission announced the official opening of the China Switzerland Securities Market's interconnected depositary receipt business.

In February 2023, the China Securities Regulatory Commission issued the "Trial Measures for the Administration of Overseas Issuance and Listing of Securities by Domestic Enterprises" and five supporting guidelines; In May, the China Securities Regulatory Commission issued guidelines that set specific requirements for the positioning, application procedures, application rules, and material requirements of GDR overseas issuance by domestic listed companies. It clearly included the issuance of newly added basic stocks in GDR domestic registration management, and the exchange reviewed the procedures for issuing stocks to specific targets by listed companies.

It can be seen that the rules for overseas financing are continuously improving. Since 2022, there has been a significant acceleration in the selection of domestic listed companies to issue GDR for overseas financing. Among them, enterprises in the lithium battery field are more proactive, and nearly 90% of companies choose to list on the Swiss Stock Exchange.

According to incomplete statistics from Battery Network, since 2022, over 18 companies in the lithium battery field have successfully issued GDR or are actively promoting various work related to GDR issuance. From the perspective of issuance progress, 8 companies have successfully issued, 8 companies are advancing their issuance matters, and 2 companies have officially announced termination.

Specifically, lithium battery companies Guoxuan High Tech and Xinwangda, upstream battery materials and equipment companies Shanshan Co., Ltd., Greenmei, Koda Manufacturing, Hangke Technology, Dongwei Technology, and Dongfang Shenghong, which has just crossed the lithium battery industry, have successfully issued and listed a total of 8 companies.

Among them, the lithium battery companies that successfully issued GDR in 2023 include Hangke Technology and Dongwei Technology, both from the Science and Technology Innovation Board.

On February 22, Hangke Technology landed on the SIX Swiss Exchange by issuing GDR, becoming the first company on the Science and Technology Innovation Board to successfully issue GDR. The company has set the GDR issuance price at $13.69 per share, with a total fundraising of approximately $173 million. The company was listed on the Science and Technology Innovation Board in July 2019, mainly providing customers with overall solutions for lithium battery aftertreatment systems.

On June 13, the GDR issued by Dongwei Technology was listed on the SIX Swiss Exchange, which was the first enterprise to successfully issue GDR after the new GDR regulations were issued. The GDR issued by the company this time was at a price of $17.80 per share, and the total amount of funds raised was about $105 million. The company was listed on the Science and Technology Innovation Board in June 2021 and is a manufacturer of high-end precision electroplating equipment and supporting equipment. Its products are mainly aimed at the fields of PCB electroplating, general hardware electroplating, and new energy electroplating. Among them, new energy coating equipment and vacuum magnetron sputtering equipment can be widely used in power batteries, energy storage batteries, 3C electronic batteries, and other fields.

In addition, GDR matters of 8 companies in the lithium field, including Tianneng, Xingyuan Materials, Jerry, Tinci Materials, Yongtai Technology, Huayou Cobalt, Pioneer Intelligence and Shengxin Lithium Energy, are still being promoted.

From the announcements issued by A-share listed companies mentioned above, the main purpose of issuing GDR is to introduce high-quality foreign investors and improve the level of corporate governance; Strengthen overseas investment and financing capabilities, and enhance international market awareness; Accelerate the development of overseas markets, enhance global competitiveness, and so on.

It is worth noting that in terms of strengthening high-level open cooperation in the field of new energy vehicles, Xin Guobin, Vice Minister of the Ministry of Industry and Information Technology, said at the regular policy briefing of the State Council a few days ago that enterprises from all over the world are welcome to invest in China, support enterprises from all over the world and Chinese enterprises to carry out various forms of cooperation in the fields of Solid-state battery, automatic driving, etc., give full play to their respective advantages, and jointly solve technical problems in industrial development, Accelerate the implementation of technological breakthroughs and industrial applications. At the same time, we also support Chinese enterprises to go abroad and invest and establish factories overseas, bringing our advanced technology and products abroad, and allowing more people from other countries to enjoy the fruits of technological progress.

According to Battery Network, there are currently 28 overseas lithium battery companies in China (including battery cell and module PACK factories), among which 20 factories have announced their planned production capacity, totaling over 506.5GWh.

At the same time, relevant material and equipment companies have also started to follow the pace of battery companies and accelerate the development of overseas markets. According to news from Huayou Cobalt Industry, on June 21 local time in Hungary, the official promotion ceremony of Huayou Bamo Hungary's high nickel ternary positive electrode material green intelligent manufacturing project was held at the Hungarian Ministry of Foreign Affairs, marking the official launch of Huayou's investment in the construction of new energy lithium battery material projects in Europe.

According to Chen Hongliang, President of Huayou Cobalt Industry, the company plans to invest in the construction of a green intelligent manufacturing factory for high nickel ternary positive electrode materials in Achi City, Hungary. The factory's products will meet the needs of battery factory customers such as CATL, EVE, AESC, LGES, and are expected to be applied to new energy vehicles of European car companies such as BMW, Volkswagen, and Renault.

In this context, with the positive demonstration effect of the successful issuance of GDR by industry chain enterprises, it is expected that more listed companies in the lithium battery industry will choose to issue GDR for overseas financing.

In addition to the companies listed in the table above, there are also listed companies in the lithium battery industry that have not announced the issuance of GDR, but have also received relevant news.

For example, in February this year, foreign media reported that CATL, a leading power battery company, was considering issuing GDR in Switzerland and might raise between US $5 billion and US $6 billion. According to insiders, CATL has discussed GDR issuance and listing with potential consultants, which may be carried out as early as this year. In addition, relevant discussions are still ongoing and details may still change. However, CATL would not comment on this news.

However, the risks of issuing GDR cannot be ignored, such as foreign regulatory risks, redemption risks, dilution risks of earnings per share, and so on.

With the adjustment of the conditions for the issuance and listing of GDR, the number of cases of terminating the planned issuance of GDR in 2023 is also increasing. On June 21st, two companies involved in lithium battery business announced the termination of their planned issuance of GDR on the same day.

Among them, while announcing the termination of planning to issue GDR, Lingyi Zhizao changed its refinancing method to issuing convertible bonds. The company stated that based on the changes in domestic and foreign capital markets, it has conducted a comprehensive review of its current operational situation, funding arrangements, and long-term business strategic planning. In order to effectively safeguard the interests of all shareholders, after careful analysis and communication, the company plans to adjust the refinancing method from overseas issuance of Global depository receipt to issuance of convertible corporate bonds to unspecified objects.

According to BatteryNet, Lingyi's manufacturing business covers the entire industry chain of precision functional components, structural components, modules, and high-quality assembly business. In 2021, the company acquired Zhejiang Jintai and laid out battery structural components such as aluminum shells, cover plates, and adapters for power battery cells. Currently, production bases in Huzhou, Suzhou, Liyang, Fuding, and Chengdu have been established. In the first quarter of 2023, the company's revenue from power battery structural components continued to grow rapidly.

Another company that stopped planning to issue GDR was Jerry Shares. In its announcement, Jerry said that, in view of the changes in external and internal environment and other objective factors, the company decided to stop issuing Global depository receipt overseas after careful analysis by comprehensively reviewing the company's financial and operating conditions, capital needs and strategic development plans, and taking full account of shareholder suggestions.

It is reported that Jerry's main business involves high-end equipment manufacturing, oil and gas engineering and oil and gas field technical services, environmental governance, and new energy fields, among which the business involving lithium batteries mainly includes Battery recycling equipment, anode materials, etc. On June 21st, when answering investors' questions on the interactive platform, Jerry Group stated that the company's lithium-ion battery negative electrode material integration project has basically completed the construction of 65000 tons of production capacity and is in the trial operation stage. Currently, it has obtained orders for partial graphitization process and finished graphite negative electrode products.

Conclusion: From the "Shanghai London Stock Connect" to the "China Europe Stock Connect", China is continuously expanding the high-level institutional openness of the capital market. Issuing GDR and listing overseas have both advantages and disadvantages. Investment needs to be cautious, and financing needs to be more rational.

First, please LoginComment After ~